Trampoline Park Investment ROI Analysis: Middle Eastern Market Performance and Profitability Forecasts

文章目录[隐藏]

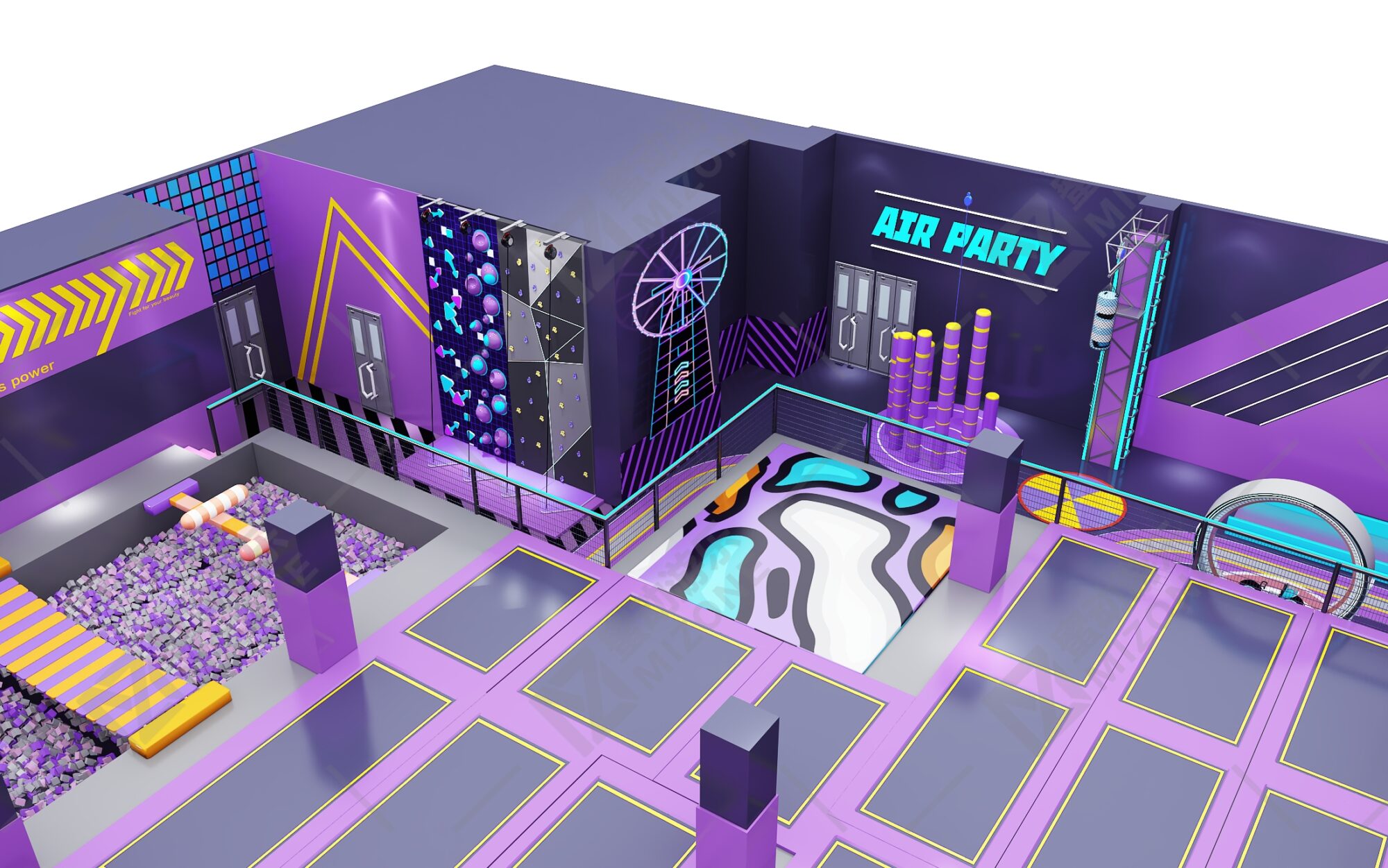

Investing in trampoline parks in the Middle East yields strong ROI, with average payback periods of 2.5–4 years, driven by surging family entertainment demand and government-backed tourism growth. As a trusted equipment supplier, MIZONE’s 8+ completed Middle Eastern projects demonstrate how cost-effective, certified trampoline solutions accelerate profitability for investors.

Middle East Trampoline Park Demand Drivers & Market Potential

The region’s entertainment boom creates urgent demand for trampoline parks, fueled by three key factors:

-

Youth Demographics: 60% of Saudi Arabia’s population is under 30, driving demand for interactive leisure (Saudi Vision 2030 targets raising entertainment spending to 6% of GDP by 2030). -

Tourism Influx: UAE’s Yas Island hosted 38 million visitors in 2024, with Family Entertainment Centers (FECs) capturing 40% of leisure budgets—trampoline parks are a high-margin segment here. -

Post-World Cup Expansion: Qatar’s Lusail New City is adding 15+ FECs post-2022 World Cup, with modular trampolines as a top equipment request.

Trampoline Park ROI Core Indicators & Cost Optimization

Trampoline Park ROI Core Indicators & Cost Optimization

Key financial metrics for Middle Eastern investors, validated by market data:

-

Initial Investment: 800,000 for a 1,000–2,000 sq.m. park (equipment 60–70% of costs). MIZONE’s trampolines cut this by 20–40% vs. European brands. -

Ongoing Costs: -

Maintenance: 5–8% of monthly revenue (MIZONE’s IoT-enabled designs reduce this by 15%). -

Compliance: 18% lower certification costs with MIZONE’s pre-approved SALEEM (Saudi) and GSO (UAE) equipment.

-

-

Revenue Potential: Average daily footfall of 200–350 visitors at 25 per ticket, plus 30% from F&B and merchandise.

MIZONE’s Middle East Projects: ROI Success Cases

MIZONE’s Middle East Projects: ROI Success Cases

MIZONE’s localized solutions have proven ROI for clients across key markets:

-

Saudi Arabia: 4 operational trampoline-integrated FECs, including a Riyadh mall project. Thanks to MIZONE’s turnkey installation (6-week faster delivery), the park reached break-even in 2.8 years—6 months ahead of industry average. -

Qatar: 4 post-World Cup venues using MIZONE’s eco-friendly modular trampolines (meeting 40% carbon reduction standards). These parks report 12% higher visitor retention vs. competitors. -

UAE: MIZONE is finalizing trampoline supply for Yas Island FECs, leveraging its DEAL 2025 partnerships to streamline logistics (cutting 15–20% transportation costs).

Actionable Steps for Trampoline Park Investors

-

Prioritize certified equipment to avoid compliance delays (MIZONE’s ISO/SALEEM-certified trampolines reduce approval time by 25%). -

Opt for modular designs to adapt to high-demand areas like Riyadh’s Qiddiya or Dubai’s tourist zones. -

Partner with suppliers offering end-to-end service—MIZONE’s design-to-maintenance support cuts operational downtime by 30%.

Ready to maximize your trampoline park ROI in the Middle East? Contact MIZONE today for a customized equipment quote and market entry strategy tailored to Saudi, UAE, or Qatar’s unique demands.